Introduction: Navigating the Regulatory Maze in the AI Industry

In recent years, the crypto industry has experienced exponential growth, attracting businesses and investors eager to capitalize on the promise of digital currencies and blockchain technology. However, alongside this rapid expansion comes a complex regulatory landscape that presents numerous challenges for businesses operating in the crypto space. From Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance to regulatory uncertainty and cybersecurity risks, navigating the regulatory maze can be daunting for even the most seasoned industry participants. In this comprehensive guide, we’ll delve into the intricacies of crypto compliance and explore essential strategies for businesses to ensure regulatory adherence while thriving in this dynamic ecosystem.

Understanding the Regulatory Landscape

At its core, the crypto industry operates within a decentralized and often ambiguous regulatory environment. Unlike traditional financial markets governed by established regulatory frameworks, the crypto market is characterized by a patchwork of laws, regulations, and guidelines that vary significantly from one jurisdiction to another. This regulatory fragmentation presents challenges for businesses seeking to operate globally while complying with diverse and sometimes conflicting regulatory requirements. Moreover, the evolving nature of crypto regulations further complicates compliance efforts, as new laws and regulatory interpretations continue to emerge, requiring businesses to adapt swiftly to stay compliant.

Key Compliance Considerations

To effectively navigate the regulatory maze of the crypto industry, businesses must prioritize compliance and adopt robust strategies tailored to their specific operations and regulatory obligations. Here are some key compliance considerations to keep in mind:

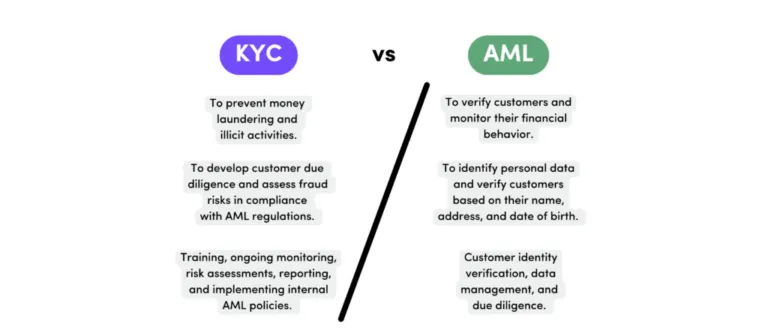

1. Know Your Customer (KYC) and Anti-Money Laundering (AML) Compliance: KYC and AML compliance are cornerstone requirements for businesses operating in the crypto industry. By implementing rigorous KYC and AML procedures, businesses can verify the identities of their customers, detect and prevent money laundering activities, and comply with regulatory mandates aimed at combating financial crime.

2. Stay Informed About Regulatory Developments: Given the dynamic nature of crypto regulations, businesses must stay abreast of regulatory developments and changes in relevant jurisdictions. Engaging with regulatory authorities, industry associations, and legal experts can provide valuable insights into emerging regulatory trends and help businesses proactively address compliance challenges.

3. Engage with Regulatory Authorities: Establishing open lines of communication with regulatory authorities is crucial for businesses seeking to navigate the regulatory landscape effectively. By engaging with regulators and seeking guidance on compliance matters, businesses can demonstrate their commitment to regulatory compliance and mitigate the risk of enforcement actions or penalties.

4. Implement Robust Security Measures: Cybersecurity is a pressing concern in the crypto industry, given the prevalence of cyber threats and hacking incidents targeting digital assets and platforms. Businesses must implement robust security measures, such as multi-factor authentication, encryption, and intrusion detection systems, to safeguard customer data and assets from unauthorized access and cyber-attacks.

5. Educate Employees and Stakeholders: Building a culture of compliance starts with educating employees and stakeholders about regulatory requirements and best practices. Providing comprehensive training and resources on compliance topics can empower employees to recognize and address compliance issues effectively, thereby reducing the risk of regulatory violations and reputational damage for the business.

Join the GrowGlobal Community

Navigating the regulatory maze of the crypto industry can be challenging, but businesses don’t have to go it alone. By joining the GrowGlobal community, businesses gain access to a supportive network of industry professionals, regulatory experts, and compliance resources designed to help them navigate regulatory challenges and achieve compliance excellence. Whether you’re a startup exploring the potential of blockchain technology or an established crypto exchange seeking to expand your global footprint, the GrowGlobal community offers a collaborative platform for learning, sharing insights, and networking with like-minded professionals. Together, let’s navigate the complexities of crypto compliance and build a more compliant and resilient future for businesses in the digital economy.

Conclusion

In conclusion, compliance is paramount for businesses operating in the crypto industry, given the complex and evolving regulatory landscape they must navigate. By prioritizing KYC/AML compliance, staying informed about regulatory developments, engaging with regulatory authorities, implementing robust security measures, and educating employees and stakeholders, businesses can enhance their compliance posture and build trust with customers and regulatory authorities alike. Join the GrowGlobal community today and embark on a journey toward compliance excellence and sustainable growth in the dynamic world of crypto.